Treating customers fairly to meet the Financial Conduct Authority (FCA) requirements.

How to unequivocally demonstrate that your customers are treated fairly to meet the Financial Conduct Authority (FCA) requirements.

An independent evaluation of your client/customer experience levels will help you acquire the insights needed to drive business performance while demonstrating your compliance with FCA directives.

Choosing an independent company to perform your evaluations and achieve accreditation from a recognised association, will reinforce your values as a customer-first business. It will also prove to others that you not only meet but exceed the required standards that the FCA demands.

The FCA website states:

All firms must be able to show consistently that the fair treatment of customers is at the heart of their business model.

The Problem.

At Investor in Customers (IIC), one of the main issues we see within the financial services sector is the inconsistent approach as to how companies measure the fair treatment of their customers. The problem lies with the inability of each company to make a like for like comparison, using a consistent set of principles and measurements for assessing customer fairness.

Whilst keen to conduct evaluations, firms rarely take an independent approach. Many believe their in-house team can manage the process, and it often falls to HR or the marketing team to undertake it. The problem is that there will be gaps in this approach which results in inconsistencies throughout the customer experience.

Without taking a comprehensive and consistent approach, the feedback and insights gathered will be skewed, leaving only a partial view of a much bigger picture. Companies need to understand the benefits of taking a helicopter view of the entire organisation to highlight areas for improvement in the customer experience.

Statistics, based on more than 14 years of Investor in Customers evaluations are very revealing:

Over 70% of managers and staff rate the customer experience (CX) they provide, higher than their clients do.

This substantial number comes from a mix of miscommunication, misunderstanding and missed opportunity.

Can you imagine what this equates to in monetary terms for your company not to mention the penalties from non-compliance?

One final point to discuss is the politics and hierarchy within firms. Internal politics not only hinder but have a severe impact on the CX. If there is an inherent culture of blame within the organisation, this can prevent the truth from emerging and long-term, harmful practices being resolved.

The benefits of employing an impartial, independent company to undertake your evaluations far outweigh the costs involved. The independent assessor has no affiliations or alliance to specific teams or leaders within the firm, there are no consequences to their words and actions when they indicate the truth and highlight problems. An independent evaluator can speak openly and honestly across all levels of the business, with their intention focused on improving performance and outcomes for all stakeholders.

The Solution - Performing an independent evaluation.

There are several significant ways in which you can demonstrate your commitment to the fair treatment of your customers whilst achieving an impactful client experience.

We’ve identified the top three we know have the most significant impact:

1. The Independent Factor.

Independently assessing the experience levels of your customers ensures you can identify inconsistencies and bridge the gap for improving the customer experience.

As experts in our field at IIC, we know the right questions to ask to get the answers that lead to positive change and performance. It will also demonstrate without a doubt that you are treating your customers fairly and meeting FCA requirements.

‘The “Gold” award and previous 3-star award that we have been awarded from an independent survey undertaken by a recognised association, has held us in high esteem with several clients. It is one of our USP’s and the feedback that it has provided, has helped us change the culture of our business and have a better understanding of our staff and client’s expectations.’ A leading insurance firm

Agile resources that enable you to adapt quickly to customer needs.

The finance sector has undergone an immense transformation over the past few years and continues to evolve to maintain a fair and ethical treatment of its customers. This is a positive move for companies who wish to establish long-term relationships with their customers, built on a foundation of trust and loyalty.

“Our research has given us clear evidence that agile companies who evolve and adapt to their client’s needs see an increase in profits within a year.” Tony Barritt. MD at IIC.

Raising standards, delivering relevant services, and a seamless and transparent process for communications and exchanges of feedback are prime factors in exceptional customer care.

Having the ability to change and manoeuvre quickly to serve your customers and meet their needs, enables you to deliver exceptional service and stay ahead of the competition while meeting FCA standards.

2. Culture, Leadership and Management.

One aspect of the FCA’s role is to highlight areas that can help leaders in the financial services sector improve customer experiences. One of their priorities is to nurture and grow a healthy culture within firms. The FCA believes a positive and purposeful culture within firms can only lead to good outcomes for customers, employees and investors alike.

The leader’s vision MUST drive the company culture, it is their responsibility to share that vision which underpins the firm’s values and priorities. Understanding purpose is a crucial driver for employees, and it directly impacts positive customer experiences.

At IIC, we have identified that employees who feel this level of purpose, demonstrate and deliver higher levels of CX.

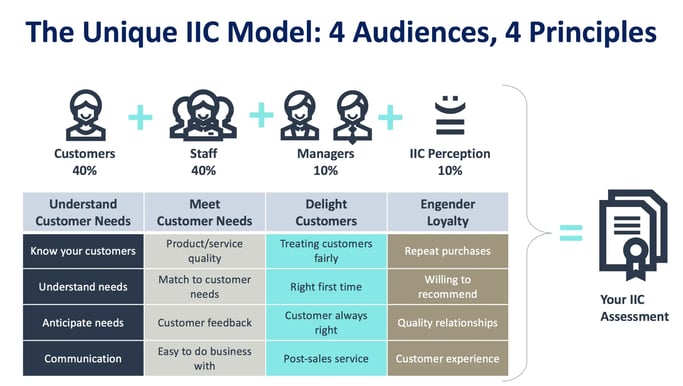

With over 3 million surveys completed, our research tells us that this directly correlates with increased customer service levels. However, without our four-principle model, which speaks directly to customers, employees, management and the IIC perception, we would never have appreciated the importance and impact of a multifaceted approach to gathering information.

Before you decide how to conduct your customer survey evaluations, consider your priorities.

What outcomes do you want to achieve?

1. Compliance?

2. Improve customer touch points?

3. Increase the overall customer experience?

4. Increase employee morale?

5. Convert satisfied customers to loyal customers?

6. Identify new areas for growth?

7. The innovation of new products and services?

8. Highlight gaps in the customer journey?

9. Gain a competitive advantage?

10. All of the above?

3. Increasing performance, profitability and compliance.

Conducting independent and comprehensive customer surveys is one of the most valuable practices financial service firms can adopt. While it helps to gather accurate data to improve CX levels, it’s the fact that an independent company has awarded you an accreditation, that instils confidence in customers. The impact that can have on your long-term growth is invaluable.

It’s also important to consider what you will do with the results of your evaluations. An independent evaluator will have an impartial view on your results, plus it will provide a perspective on where you are today, where you want to be tomorrow and how to get there.

The data you gather and its impact must be understood, and decisive action taken as a result. All stakeholders within the firm need to be on-board with the decisions made and plan to improve and enhance the CX.

Employing an independent practice to conduct your evaluation will have a significant impact on the overall result. It isn’t something you must do to simply comply with FCA requirements, it also makes sound commercial sense. Knowing what your customers want and what you need to do to meet their needs, will ensure your customers stay with you longer, increase spend and tell other people positive things about your firm.